Donald Trump stops in the White House hall to listen to the band to conclude “one, big, beautiful.”

(Chip Somodevilla / Getty)

When President Trump first signed the bill in 2017, eliminating the status exempt from taxes, many people used a private university, Kevin Brady-Congress Representative, who oversees the Tax Code, rewriting as chairman of the Committee of Mighty Ways and Merzh. Education. “

In the face of further taxes to a small subgroup of private colleges in the United States, GOP justification has changed. The successor of Brady, a representative of Jason Smith, has put raised fees as a way to attract “elite, universities and non -profit organizations”.

The 800s plus “One Big Big Bill” is laid on the republican page of the 800’s Plus on Improving the Income Tax from Choosing Private Gifts from the current 1.4 percent rate to 4 to 8 percent. The beginning is calculated by the division of the school giving size by the number of unpretentious students, which they take into account, withdrawing the number providing the amount of money stored in gifts per student. The higher the rate for the study for study, the higher the tax. This creates an incentive structure, states republicans that it calls for colleges to spend more gifts for financial assistance and the experience of learning students, rather than bringing it riches into what effective hedge -foons. But higher education experts challenge this, claiming that the funds serve to reduce the cost of education.

During a survey of 645 American institutions of the National Association of College and University Business Service, financial assistance was almost half of all expenses. Academic programs and research accounted for another 17 percent and teachers are almost 11 percent. “Teachers and staff certainly use this charity, but students remain the main beneficiaries, because the bulk of these resources are used to maintain the help and availability of students,” said Nacubo President and CEO of Freeman.

Increasing the tax burden for these colleges can distract funds from these programs, adversely affecting access to education, Philip Levin, senior non -resident at the Brookings Institute and Economics Professor at Wellsley’s College, said Nation. “These very endowed colleges are the least expensive college options for students who may be $ 150,000 a year,” he said. “They can do it from their great gifts.”

Another Qualm GOP, according to Smith, is that colleges used their multi -billion dollar funds to push political ideology. “It ends now. If these institutions want to act as corporations, we will treat them as corporations.”

However, the awards have strict rules that regulate them. The amount of money that can be pulled from them annually is regulated by state laws. Donors also suggest how their money can be used. Some donate to professors’ ashtund. Others donate to increase financial assistance to students, financing the construction of a building or financing research.

The existence in the world, which has been largely exempt from taxes since the early 1900s, higher education institutions are enjoyed by a federal tax proceedings because of their mission and contribution to civil society. “Higher education is absolutely a civic responsibility,” the director said in an interview after the Secondary Policy on Education Reform, citing her ability to provide social mobility to his students and promotes scientific research.

Stephen Bloom, Assistant Vice -President for Relations with the Government of the US Education Council, went to name American higher education “asset of national security”. “They are a magnet for the most striking students and scientists in the world,” he claimed.

In 2019 paper May K. Quinn, Professor of Legal Law in Peng, claimed that colleges could simply use the funds in the ways that make higher education more fair, such as financial assistance. The costs of these funds exempt them from the tax, while benefiting the unfortunate groups that are at risk of Trump’s administration, she claims. “If rich colleges simply use more of their great savings for further social justice, influence on poverty and enhancement of public good-and-peculiarities in their own risk communities not only avoid federal taxation, but also begin to consider criticism of their elitivity and greed,” she wrote during the first term.

But when Trump’s administration escalate its US -re -dispatching campaign after secondary education through billions of federal funds and launching countless investigations, this last tax is regarded as punitive stakeholders in a political spectrum.

“The tax is accurately directed at the” woken up “universities,” said Neil McCluski, director of the Central Freedom Center at the Kato Institute, the Libertarian Analytical Center. “The tax system should not be used to punish people for their ideological beliefs.” But McCluski believes that the federal government must disable all financing of higher education, “not to punish higher education, but to follow a constitution that gives Washington neither powers to finance students’ assistance nor most research.”

Popular

“Spend on the left below to view more authors”Spend →

Hillsdail College follows this model. The Conservative, Religious Institute, Hillsdale refuses any federal financing after the founding in 1844, pointing out that state funding could lead to attached lines. Still his president, Larry Arn, publicly reproached The tax on the gifts claiming that “he fines the most rigid institutions that have chosen the tougher path of independence, which refuses to confuse the federal subsidy.”

Having received most of his financing through charitable gifts, the college president claimed that “taxation of these gifts is a tax philanthropy – to load those who will lift the load.” If the tax came into force, Arn said: “It would make us reduce resources, limit opportunities, transfer the load to students and their families – all in the name of justice that is not fair.”

Other colleges expressed a similar alarm, predicting the scripts of the day when Trump accepted such a collection. On Friday, Trump signed legislation and a new tax in the law. Nation He turned to dozens of colleges to understand how they are preparing for a potential tax increase and how it would affect their students. Only one answered, Baylor’s medical college to say they did not believe that the tax was intended for targeting small private medical schools. Their general lawyer Robert Carigan added that “we are now working with our chosen representatives to make a decision on the issue.”

These institutions were widely lobbied on the Capitol hill against such tax raising proposals, the said Nation. Bloom lobbys these issues of taxation on behalf of the American Education Council, an organization consisting of 1600 higher education institutions. His step for legislators against taxes is caused by traditional republican topics of the small federal government. Submitting this profit, he states: “You select money from other useful goals and send it to Washington.”

Some in higher education are still fighting against the tax tax, but open to reforms. Murphy suggested using a punitive tax measure to push colleges to work on “desirable results”. According to him, this includes tax benefits for those who eliminate outdated benefits when admission or exceeding the threshold as a percentage of students who are entitled to Pell Grant. Bloom said the ace wants the tax to be abolished either “reformed ways that promote the schools to do more in terms of financial assistance and research.”

More than Nation

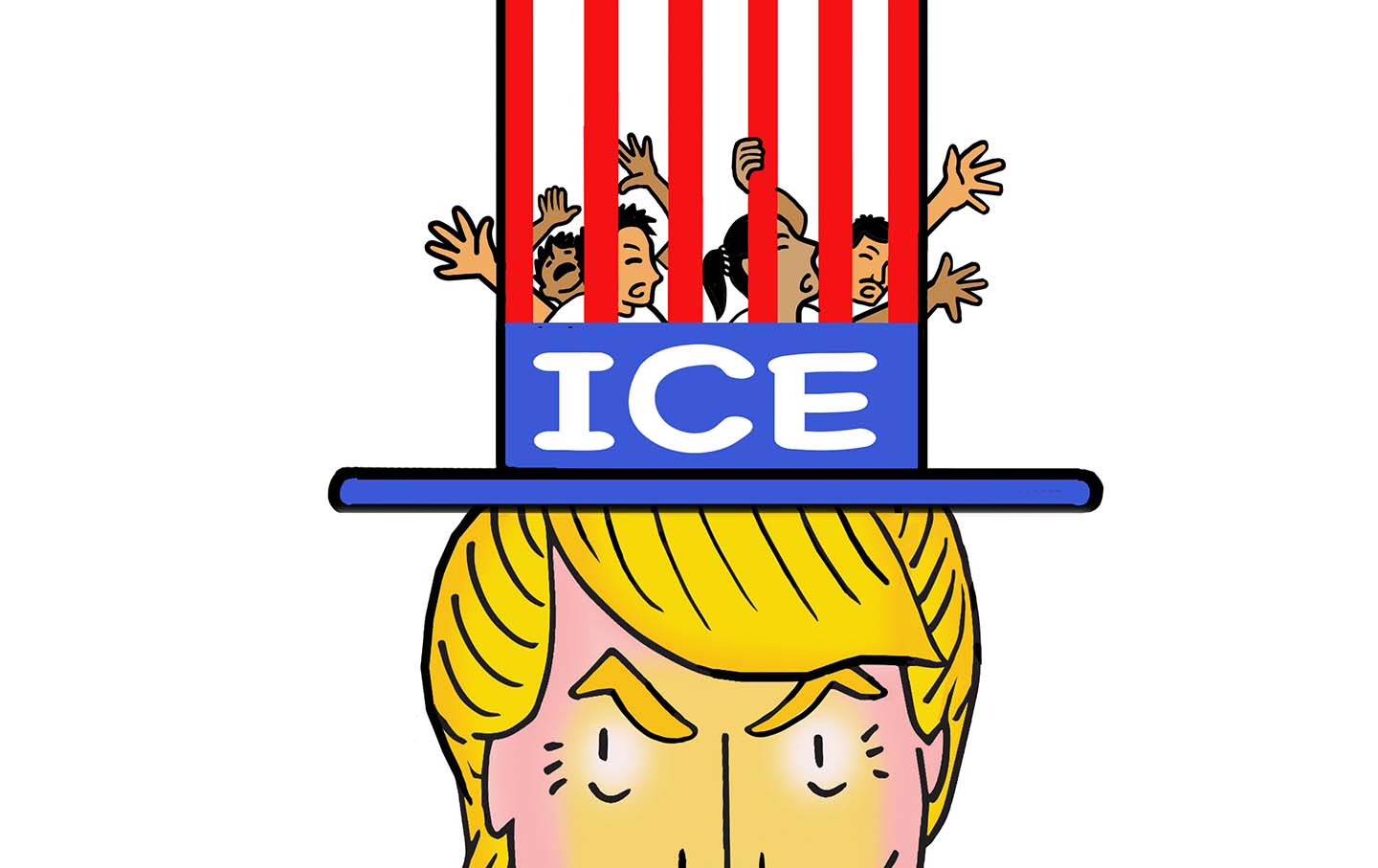

ICE pursues more arrests than if, the vast majority of people detained this fiscal year, did not have criminal beliefs, and Trump pushes for more execution.

Problems that once thought that long settled is now grip again. But “they are not going to get what they want,” says Omar Jadwat from the ACLU immigrant rights project.