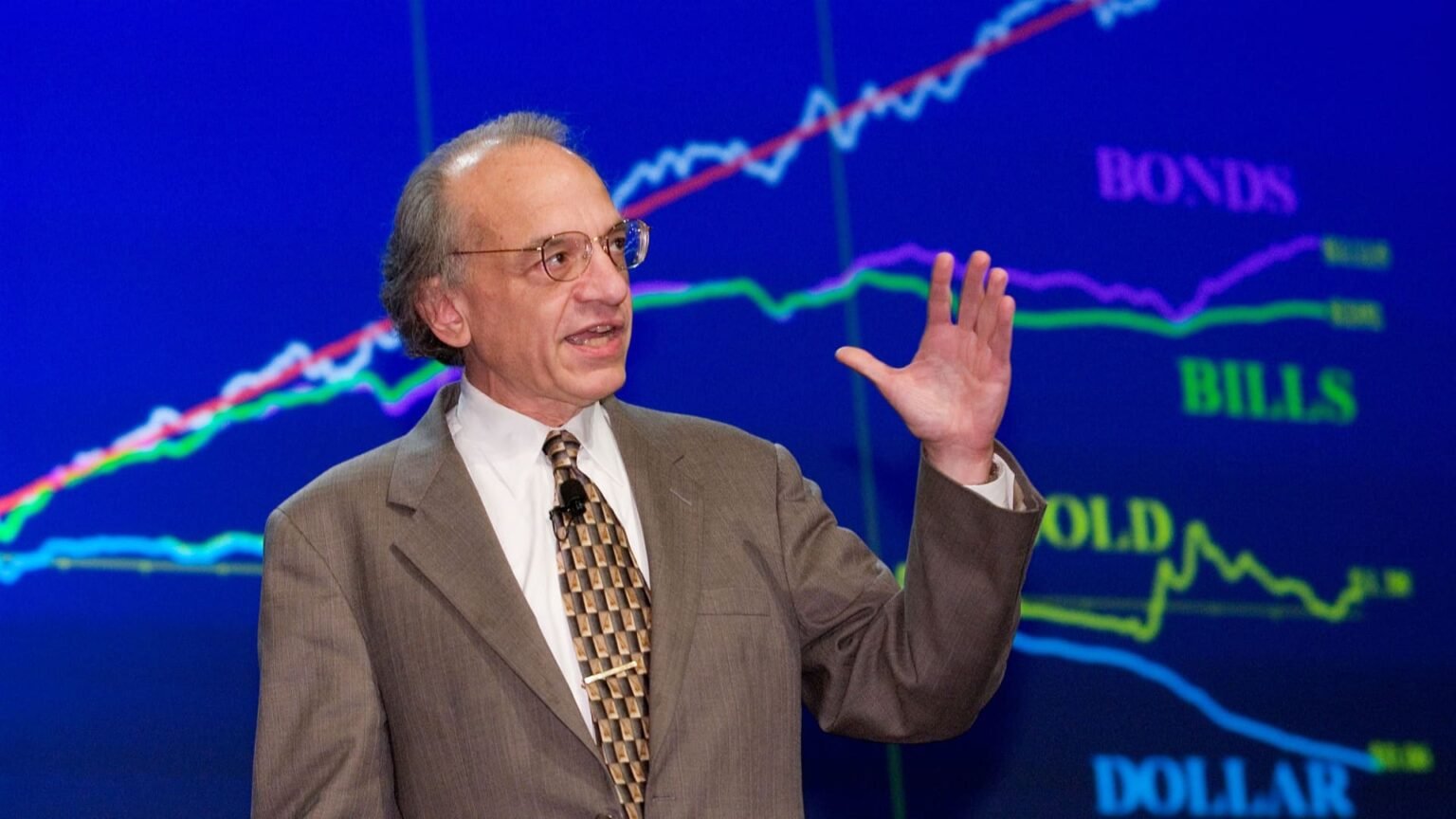

The selloff in Wall Street stocks was “healthy” as the Federal Reserve’s cautious outlook for future rate cuts gave investors a “reality check,” according to Jeremy Siegel, professor emeritus of finance at the University of Pennsylvania’s Wharton School.

The US Federal Reserve cut interest rates a quarter of a percentage point at the last meeting of the year, bringing the overnight lending rate to a target range of 4.25% to 4.5%. Meanwhile, the Federal Open Market Committee indicated that it will likely cut rates two more times in 2025, down from the four cuts indicated in its September forecast.

The three Wall Street’s major indexes sank In response to the revised Fed forecasts, investors were betting on the central bank to continue to reduce borrowing costs more aggressively.

“The market was almost in a runaway situation … and that brought the reality that we’re not going to get low interest rates” as investors had been betting on when the Fed easing cycle began, Siegel told CNBC. “Squawk Box Asia.”

“The market was overly optimistic … so I’m not surprised by the selloff,” Siegel said, adding that the Fed expects to reduce the number of rate cuts next year, with one or two cuts.

He said there is also a “chance of no tapering” next year, as the FOMC raised its inflation forecast going forward.

The new Fed outlook shows officials expect the personal consumption expenditures price index, excluding food and energy costs, or core PCE. They increase by 2.5% until 2025still significantly higher than the central bank’s 2% target.

Siegel suggested that some FOMC officials may consider the inflationary effects of potential rates. President-elect Donald Trump has vowed to do so Set additional tariffs in ChinaCanada and Mexico on the first day of his presidency.

But the actual tariffs may not be “as big as the market fears,” Siegel said, with Trump likely looking to avoid any stock market setback.

Market participants now expect the Fed to don’t cut rates until the June meetingprices have a 43.7% chance of a 25 basis point cut at that point, according to CME’s FedWatch tool.

Marc Giannoni, chief US economist at Barclays, maintained the Fed’s baseline projection of two 25 basis point rate cuts next year, in March and June, while fully internalizing the effects of the rate hike.

Giannoni said he expects the FOMC to resume rate cuts around mid-2026, once inflationary pressures from tariffs have dissipated.

The data provided earlier this week showed US inflation rose at its fastest annual pace in November, the consumer price index reached a 12-month inflation rate of 2.7% after rising 0.3% in the month. Excluding variable food and energy prices, main consumer price index It increased by 3.3% year-on-year in November.

“It’s a caveat and a surprise to everyone, including the Fed, that given how high short-term rates have been relative to inflation, the economy may be as strong as it is,” Siegel added.

The Fed has entered a new phase of monetary policy: the pause phase, said Brandywine Global portfolio manager Jack McIntyre, “the longer it goes on, the more likely markets will pay the same price for a rate hike versus a rate cut. .”

“Policy uncertainty will lead to more volatile financial markets in 2025,” he added.